Topics on this page:

So, you have a business plan. More than that, you’re ready to put this dream into action. But with all the expenses you know to expect, you still have one looming question: how much can you expect to make? In this article, we’ll walk you through all the elements you’ll need to consider so you can identify a salary that’s reasonable and still allows you to to turn a profit.

There are four things to consider, according to payroll site Gusto.com, when determining how much a small business owner gets paid:

Once you calculate these four things, you should have a better idea of how much you’ll have left over to pay yourself. You can determine if you’ll pay yourself:

Every business has different operating costs, including how many (if any) people are employed. As the business evolves, so, too, will the owner’s salary.

In one case study from a February 2020 CNBC.com article, two co-founders discussed how they decided to pay themselves after starting a business in 2018. The owners knew they’d need to invest in marketing and hire employees eventually, but first they’d need to know how much to keep for themselves to live. They used the four factors listed above to determine an equal amount each month that would be enough to cover their personal expenses. They hired employees after several months, becoming an S Corp and forcing them to abide by Internal Revenue Service guidelines when it came to their salaries as owners. The co-founders used Glassdoor.com to compare similar salaries and find out what they should reasonably pay themselves. They chose the low end so that their business could continue to make a profit while paying their salaries.

Many sources will tell you that most small businesses won’t make a profit until their third year, if they survive that long. But some businesses with little overhead or startup investment and a lot of growth could have higher profitability early on.

You can use this formula to figure out if your business will be profitable in the first year:

Revenue – Expenses = Profit

For example, if your business brings in $75,000 for the year, but you have $40,000 in expenses, you will end up with a $35,000 profit.

The SBA estimates that between 1994 and 2018, about two-thirds (67.6%) of small businesses survived at least two years. Most small businesses (64.4%) receive their starting capital from personal and/or family savings. Other common forms of small business financing include a business loan, personal credit cards, and/or other personal family assets. The SBA offers extensive help for managing your finances and helping make sure your business will make a profit. They offer a balance sheet template to account for costs, as well as thorough explanations about how to decide how your business will do its accounting.

Knowing where your money is coming from and where it’s going is the first step to determining how much you’ll have left over to pay yourself as the owner.

Some of the most popular skills for small business owners in the U.S. include sales, business management, operations management, project management, and business development, according to Payscale.com. Of those skills, business development was the most profitable, at an average $77,511 salary per year. That means, if you’re developing your own startup, you could wind up making some pretty good money … eventually.

Payscale.com says entry-level small business owners with less than a year experience might only average about $39,000 per year. However, that number gradually increases with years of experience. By the time a business owner has 20+ years of experience, they can expect to make way above the average small business owner’s salary, at more than $81,000 per year. Individuals who own small businesses late in their career earned 16% more than the national average.

The same Payscale.com data lists Boston as the city with the highest pay for small business owners. At $__, owners in Boston earned about 76% more than the national average of $__. Chicago, Minneapolis, and Houston all ranked as cities where a small business owner might make more money than the national average. On the flip side, cities like Seattle, Denver, and Los Angeles were listed as having a lower-than-average salary, with small business owners in L.A. making $__, which is 64% less than the national average.

It can be tough to make a profit in the first year of a small business, and according to Forbes.com, it’s important to figure out quickly exactly why you’re not making money. Things that might cause your business to lose money could include bad accounting, not having a business-specific bank account, incorrectly priced products, not having an online presence, and not investing in your business’ future.

There are plenty of online resources to help you calculate what your salary should be as a small business owner and when you can give yourself a raise.

One of the most current and frequently used calculators for small business owner salaries is this Google Drive spreadsheet calculator, found on sites like Freshbooks.com and Gusto.com. It asks you to enter figures like your monthly net income, tax savings, debt payments, and savings plan to calculate owner pay.

SBA.gov has a page to help small business owners determine their startup costs, including a downloadable PDF to calculate costs for your specific business. Figuring out all your costs up front, including how much you’ll need to pay any employees, will help you estimate how much money you’ll be able to bank as the owner while still keeping your business running beyond its first year. (Well-known payroll website ADP offers a calculator to determine how much to pay your employees.)

To figure out your return on assets (ROA) ratio (i.e., how efficient you are at using your business assets to generate profit), use this formula:

Here, “average total assets” refers to your company’s liability plus equity. You can usually find this number on your business’s balance sheet. If you’re wondering why you’re using “average” total assets in this formula, rather than total assets, Claire Boyte-White of Investopedia has the answer:

“Average total assets are used in calculating ROA because a company’s asset total can vary over time due to the purchase or sale of vehicles, land or equipment, inventory changes, or seasonal sales fluctuations. As a result, calculating the average total assets for the period in question is more accurate than the total assets for one period.”

If formulas aren’t your thing, you can also try out one of these ROA calculators from Bankrate.com or CCDConsultants.com.

You’ll also want to calculate your break-even point, or BEP. The BEP is the point at which your business’s sales cover (i.e., are equal to) your expenses. This is the point at which your business’s revenues equal your expenses. Kylie McQuarrie of Business.org elaborates:

“In other words, if you’re breaking even, you aren’t spending more than you’re making — which also means you aren’t making more than you’re spending. At your break-even point, your business isn’t profitable, but it also isn’t losing money: it’s at an exact net neutral.”

Calculating your BEP requires you to know three key pieces of information about your business:

Once you have this information, you’re ready to go. The most common way to calculate your BEP is to use the following formula:

By using this formula, you’ll be able to identify how much of your product you’d need to sell in order to cover your total expenses. On top of that, you’ll also now know how much more of your product you’d need to sell in order to turn a profit!

Let’s walk through an (albeit oversimplified) example so you can get a clearer picture of how this works.

Evelyn just opened her own bagel shop and wants to figure out how many bagels she’d need to sell to cover her expenses. (She’s also hoping to use this as an opportunity to see whether she set the right price for her bagels, which is $4 each.) She figures out what her fixed costs are:

All told, her fixed costs come out to $20,000. She then figures out what her variable costs are (on a per unit basis):

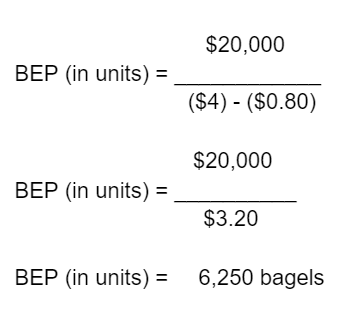

All in all, her variable costs come out to $0.80 per bagel. Now, she has all the information she needs to plug into the BEP formula:

So, as you can see, Evelyn would need to sell 6,250 bagels just to cover her expenses. If she wanted to turn a profit, she’d have to sell more than that.

If you’re not feeling so math-inclined, you can also make it easier on yourself by using this BEP calculator from the National Association for the Self-Employed.

Good luck to you and your growing business!

Image courtesy of iStock.com/artisteer

Last updated on Jul 24, 2024.

Originally published on Feb 05, 2021.

More:

The views expressed in this article are those of the author and do not necessarily reflect those of Berxi™ or Berkshire Hathaway Specialty Insurance Company. This article (subject to change without notice) is for informational purposes only, and does not constitute professional advice. Click here to read our full disclaimer

The product descriptions provided here are only brief summaries and may be changed without notice. The full coverage terms and details, including limitations and exclusions, are contained in the insurance policy. If you have questions about coverage available under our plans, please review the policy or contact us at 833-242-3794 or support@berxi.com. “20% savings” is based on industry pricing averages.

Berxi™ is a part of Berkshire Hathaway Specialty Insurance (BHSI). Insurance products are distributed through Berkshire Hathaway Global Insurance Services, California License # 0K09397. BHSI is part of Berkshire Hathaway’s National Indemnity group of insurance companies, consisting of National Indemnity and its affiliates, which hold financial strength ratings of A++ from AM Best and AA+ from Standard & Poor’s. The rating scales can be found at www.ambest.com and www.standardandpoors.com, respectively.

No warranty, guarantee, or representation, either expressed or implied, is made as to the correctness, accuracy, completeness, adequacy, or sufficiency of any representation or information. Any opinions expressed herein are subject to change without notice.

The information on this web site is not intended or implied to be a substitute for professional medical advice, diagnosis or treatment, and does not purport to establish a standard of care under any circumstances. All content, including text, graphics, images and information, contained on or available through this web site is for general information purposes only based upon the information available at the time of presentation, and does not constitute medical, legal, regulatory, compliance, financial, professional, or any other advice.

BHSI makes no representation and assumes no responsibility or liability for the accuracy of information contained on or available through this web site, and such information is subject to change without notice. You are encouraged to consider and confirm any information obtained from or through this web site with other sources, and review all information regarding any medical condition or treatment with your physician or medical care provider. NEVER DISREGARD PROFESSIONAL MEDICAL ADVICE OR DELAY SEEKING MEDICAL TREATMENT BECAUSE OF SOMETHING THAT YOU HAVE READ ON OR ACCESSED THROUGH THIS WEB SITE.

BHSI is not a medical organization, and does not recommend, endorse or make any representation about the efficacy, appropriateness or suitability of any specific tests, products, procedures, treatments, services, opinions, health care providers or other information contained on or available through this web site. BHSI IS NOT RESPONSIBLE FOR, AND EXPRESSLY DISCLAIMS ALL LIABILITY FOR, ANY ADVICE, COURSE OF TREATMENT, DIAGNOSIS OR ANY OTHER SERVICES OR PRODUCTS THAT YOU OBTAIN AFTER REVIEWING THIS WEB SITE.

Click to collapse disclamerWant Berxi articles delivered straight to your inbox? Sign up for our monthly newsletter below!

"*" indicates required fields