Topics on this page:

Your career as a nurse practitioner has many benefits, but it carries a few risks too. For example, you can be held personally liable for legal claims that arise in the course of your work. That’s why nurse practitioner insurance coverage is so important to protect you, your financial stability, and your ability to build your career. But what type of insurance do you really need?

In this article, we explain four types of nurse practitioner insurance coverage to consider: malpractice insurance, general liability insurance, workers’ comp insurance, and cyber insurance. We also explain why NPs typically buy each type of insurance to help you determine what might work best for you.

Malpractice insurance protects licensed healthcare professionals from legal and financial burdens if a patient (or their family) claims your neglect or mistake resulted in bodily injury, death, lost wages, or extra medical expenses. Many states require you to have medical malpractice to practice as an NP.

Whether you work full or part time, and whether you work for a large healthcare organization, work on a contract basis, or own your business, malpractice insurance is valuable to your career. Business owners have the added responsibility of deciding whether to include their employees on the practice’s group policy or to insure only the business.

No matter where you work and who you work for, make sure you know what type of policy you have and how much coverage applies to you. You might be surprised to learn how many NPs are shocked by a discovery that they aren’t covered by their organization’s insurance policy or that their employer-based policy is quite limited.

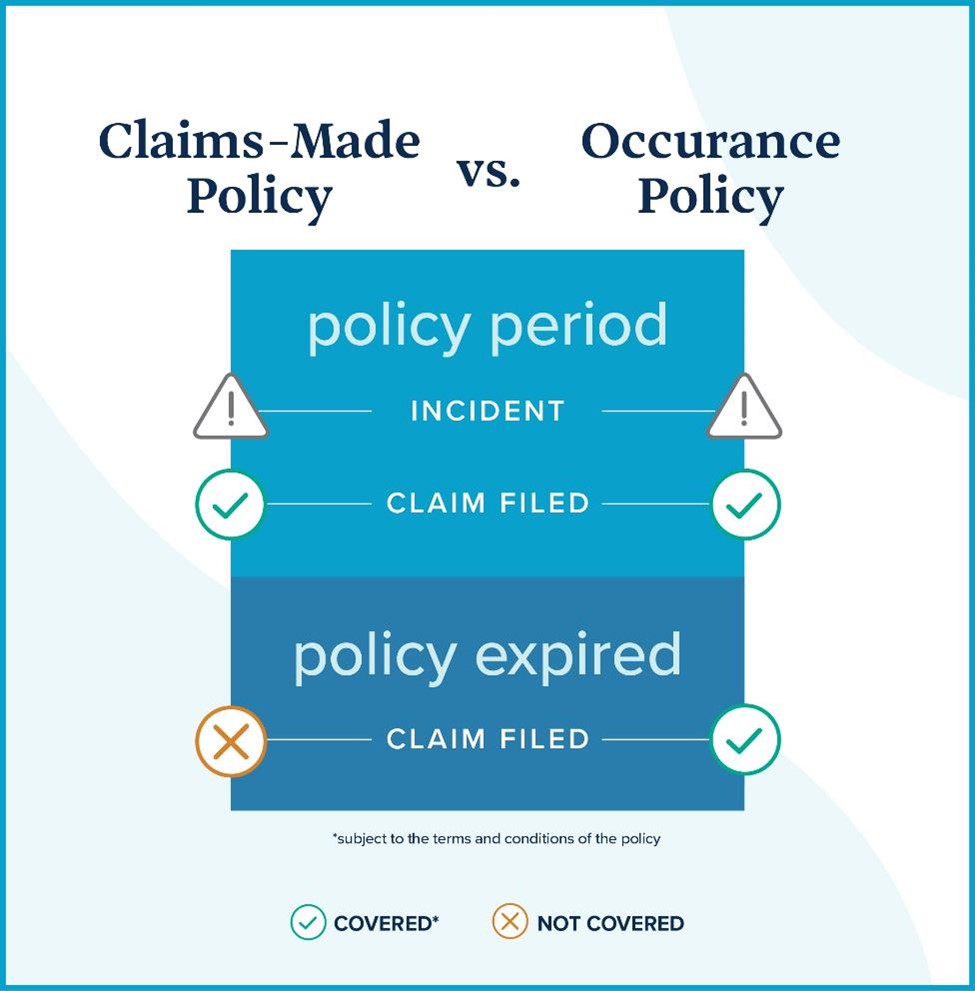

When buying NP malpractice insurance, you will likely face two options: a claims-made policy or an occurrence policy. Let us explain both types of malpractice insurance for nurse practitioners.

A claims-made policy covers only claims filed during the policy period, meaning before the policy has expired. A claims-made policy could start at a lower premium than an occurrence policy because it does not cover claims made after the policy expires.

Occurrence policies cover claims from services you performed during the policy period, even if the claim is filed after your policy expires.

Here’s an example:

Let’s say you have a side gig as an NP between 2022 and 2025, and you bought malpractice insurance to cover any claims during that time frame, letting it renew year after year. In 2025, you stopped working that job and let the policy expire. But in 2026, a patient files a claim saying you caused her harm during the policy period and she wants $100,000. You now need a lawyer to fight for your case, and you might have to pay some type of settlement. Will your medical malpractice policy help? It should — if it was an occurrence policy. If it was a claims-made policy, it would help only if you had added tail coverage.

Tail coverage for nurse practitioners is like an extension plan for your malpractice insurance, typically on claims-made policies. Say you decide to take a break from work or leave the profession. An NP tail coverage policy can ensure that you’re still covered if a former patient brings a malpractice lawsuit against you.

Take our example above of the NP with a side gig. If that NP had bought a tail policy when her claims-made policy expired, she could also be covered by her malpractice insurance when the former patient sues her for $100,000.

Your employer may offer medical malpractice coverage as part of its employee benefits. With this type of policy, your employer has already selected the insurer and negotiated the policy details. While relying only on your employer’s insurance can be convenient, doing so might limit what you’re covered for and when (for example, many employer policies don’t cover licensing board reviews). This is why a lot of healthcare workers, including NPs, buy an extra policy.

An independent or supplemental malpractice policy is a separate policy NPs and other healthcare professionals purchase to add extra protection to what their employer provides. You might want an independent policy:

An independent malpractice policy gives you more control over your coverage. For example, you’re able to choose liability limits that best suit your needs.

Many nurse practitioners own their own businesses, and general liability insurance is vital for business owners. Rather than covering errors in healthcare services, general liability (GL) insurance covers you for third-party claims of bodily injury (non-employees) or property damage (meaning your customer’s property, not yours). Think of it as the insurance you buy in case your business somehow hurts others.

General liability insurance typically provides legal defense and funds for these four types of coverages:

Berxi allows NPs to add a GL policy for only $150 per year. You’ll want to start a quote or call our support team for more info.

As an employee, you probably have workers’ compensation as an employee benefit. This usually means that if you were to get hurt while working, the company is responsible for medical expenses and lost wages due to the event.

Workers’ compensation laws vary by state, but most states require employers to carry it. So if you own a business and you have any employees, you should check your state requirements to make sure you’re in compliance with state law and have the proper workers’ compensation insurance in place.

Digital records are essential for running efficient and modern healthcare practices, but they also present risks. If a cybercriminal succeeds in attacking your business, resulting in a data breach or virus that compromises patient personally identifiable information (PII) you could be liable for patient damages, along with the cost of repairing or recovering your systems.

Cyber liability insurance covers the cost of such claims as well as post-incident support. This type of insurance may include:

While Berxi doesn’t provide cyber insurance, we work with a partner that does. Feel free to reach out to our support team to get more info.

Shopping around for the plan that best suits your needs is always smart, but buying direct from Berxi can save you up to an average of 20% on medical malpractice insurance. Nurse practitioner insurance coverage varies depending on the policy type, scope, and coverage level. On average, at Berxi nurse practitioners can expect to pay about:

* Prices based on policies with $1 million/$3 million in limits, purchased by full-time nursing professionals in the state of Texas. Policies for nurse practitioners working part time are also available at Berxi.

Berxi is part of Berkshire Hathaway Specialty Insurance Company (BHSIC). That means a policy from Berxi also comes with the knowledge that you’re supported by a company that has the highest possible financial strength rating of A++ from AM Best and AA+ from Standard & Poor’s. Get a free quote today.

Image courtesy of iStock.com/Drs Producoes

Image courtesy of iStock.com/sturti

More:

The views expressed in this article are those of the author and do not necessarily reflect those of Berxi™ or Berkshire Hathaway Specialty Insurance Company. This article (subject to change without notice) is for informational purposes only, and does not constitute professional advice. Click here to read our full disclaimer

The product descriptions provided here are only brief summaries and may be changed without notice. The full coverage terms and details, including limitations and exclusions, are contained in the insurance policy. If you have questions about coverage available under our plans, please review the policy or contact us at 833-242-3794 or support@berxi.com. “20% savings” is based on industry pricing averages.

Berxi™ is a part of Berkshire Hathaway Specialty Insurance (BHSI). Insurance products are distributed through Berkshire Hathaway Global Insurance Services, California License # 0K09397. BHSI is part of Berkshire Hathaway’s National Indemnity group of insurance companies, consisting of National Indemnity and its affiliates, which hold financial strength ratings of A++ from AM Best and AA+ from Standard & Poor’s. The rating scales can be found at www.ambest.com and www.standardandpoors.com, respectively.

No warranty, guarantee, or representation, either expressed or implied, is made as to the correctness, accuracy, completeness, adequacy, or sufficiency of any representation or information. Any opinions expressed herein are subject to change without notice.

The information on this web site is not intended or implied to be a substitute for professional medical advice, diagnosis or treatment, and does not purport to establish a standard of care under any circumstances. All content, including text, graphics, images and information, contained on or available through this web site is for general information purposes only based upon the information available at the time of presentation, and does not constitute medical, legal, regulatory, compliance, financial, professional, or any other advice.

BHSI makes no representation and assumes no responsibility or liability for the accuracy of information contained on or available through this web site, and such information is subject to change without notice. You are encouraged to consider and confirm any information obtained from or through this web site with other sources, and review all information regarding any medical condition or treatment with your physician or medical care provider. NEVER DISREGARD PROFESSIONAL MEDICAL ADVICE OR DELAY SEEKING MEDICAL TREATMENT BECAUSE OF SOMETHING THAT YOU HAVE READ ON OR ACCESSED THROUGH THIS WEB SITE.

BHSI is not a medical organization, and does not recommend, endorse or make any representation about the efficacy, appropriateness or suitability of any specific tests, products, procedures, treatments, services, opinions, health care providers or other information contained on or available through this web site. BHSI IS NOT RESPONSIBLE FOR, AND EXPRESSLY DISCLAIMS ALL LIABILITY FOR, ANY ADVICE, COURSE OF TREATMENT, DIAGNOSIS OR ANY OTHER SERVICES OR PRODUCTS THAT YOU OBTAIN AFTER REVIEWING THIS WEB SITE.

Click to collapse disclamerWant Berxi articles delivered straight to your inbox? Sign up for our monthly newsletter below!

"*" indicates required fields